SERVICE DESIGN

Creating ASIC’s Financial Wellbeing Network

One in three Australians find dealing with money overwhelming, and nearly half of Australia’s 12.6m workers worry about their financial situation. In response, ASIC designed their Financial Wellbeing Network; a service bringing together a diverse group of organisations all helping Australians to be in control of their financial lives.

Design Challenge

ASIC always recognised the vision for ‘Australians in control of their financial lives’ was one they couldn’t achieve on their own; and the existing partnerships and stakeholder strategy wasn’t doing enough.

A reimagined service needed to:

- Attract and retain new members while increasing the diversity of member organisations

- Increase quality of engagement with organisations and the value of participating

- Understand and establish ways to measure the impact of organisations working in financial wellbeing

- Build confidence in a redefined strategy and investment in a two year roadmap

- Support cultural change needed to shift from a centralised approach to a platform model.

Design Solution

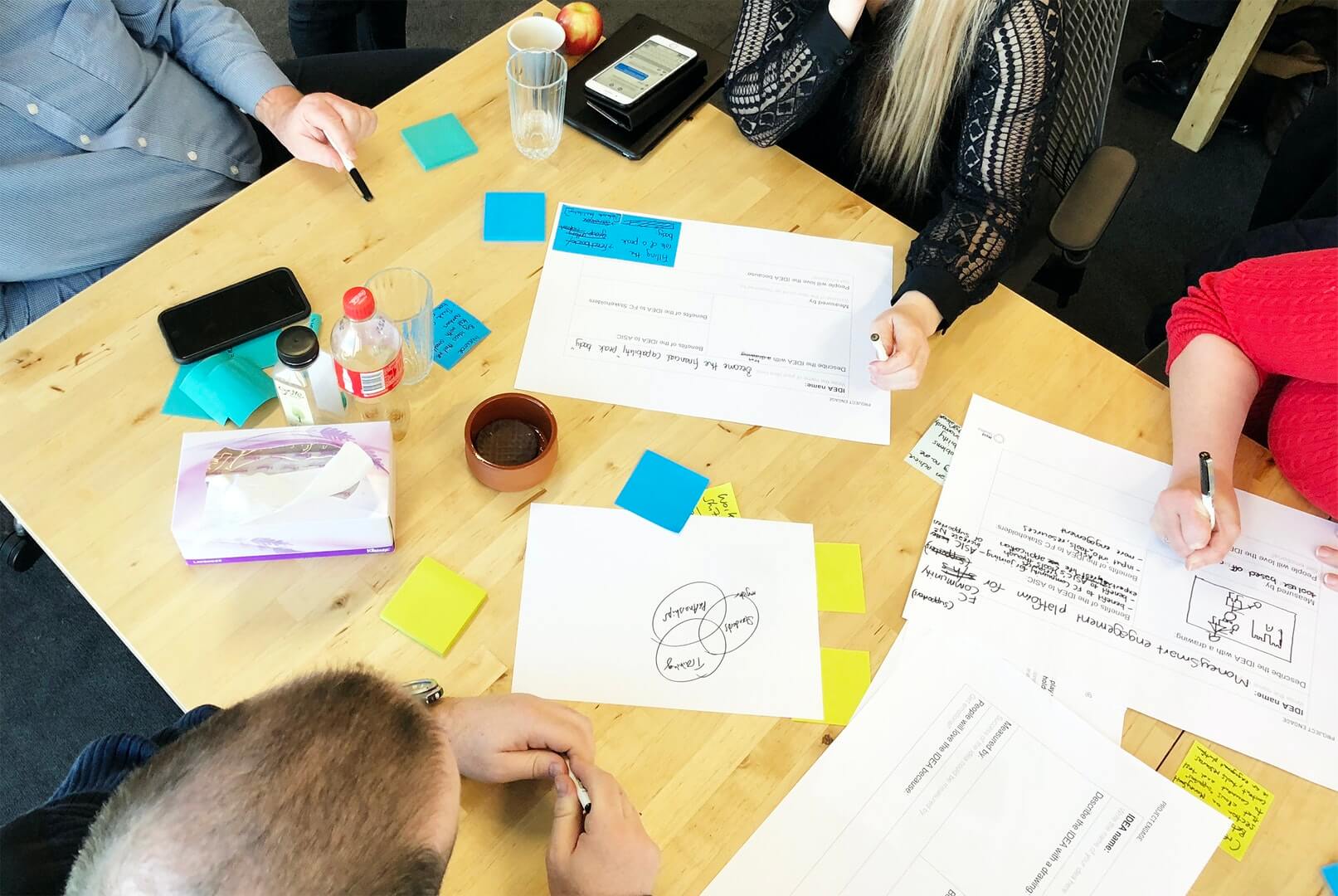

We worked with ASIC’s project team, their stakeholders and prospective and existing member organisations to:

- Create ASIC’s Financial Wellbeing Network which brings together practitioners, educators, researchers, policy makers, academics and other professionals using a cross-sector platform that supports members to connect, collaborate, share knowledge and discover new evidence-based approaches to improving Australians’ financial wellbeing.

- Support translation of the new platform model and rebrand to all new initiatives and communications; including the Financial Capability website, e-newsletters, research hub, state and national events, collaboration initiatives and a monitoring and evaluation framework for measuring impact.

Design Impact

40% growth in the three months to December 2018 with more than 100 new organisations joining; increasing diversity of members, participation and societal reach.

A shift in mindset and language from financial ‘capability’ to financial ‘wellbeing’; setting the scene to elevate the connection between financial wellbeing and mental health for greater social impact.

Investigation of the role of employers in actively supporting the financial wellbeing of their employees. In 2020, this empowered ASIC to be on the front foot in response to the COVID-19 pandemic; collaborating with the mental health sector on the intersection between financial wellbeing and mental health.

Other Key Features

Foundations for a national dialogue

Like the stigmas associated with mental health, they also exist when Australians discuss their finances, especially debt. There is systemic value in a national agency, known for its role as a regulator, being prepared to raise a conversation on what is not a well known or widely addressed link between mental health and financial wellbeing. It’s an important step in a move from an under-resourced area, not necessarily well coordinated, to a system where building people’s financial confidence and resilience becomes an intrinsic part of our lives.

Open and adaptable to what we learn

The project supported people to trust the design process; fuelling the courage and curiosity needed to challenge conventional wisdom and long-held assumptions. The team kept an open mind and acted on insights; leading to crucial explorations like an in-depth look at the role of employers in their employees financial wellbeing.

Be the change we wish to see

Design was used as a vehicle for strengthening relationships; demonstrated by building design-led capabilities internally. Organisations participating could experience first-hand ASIC’s commitment to evolving their approach. This led to them wanting to engage with ASIC more meaningfully in future; and increasing the network’s value.

Related case studies

SERVICE DESIGN

Transport as a service in Sydney’s North West

We worked with customers and transport stakeholders to orchestrate how all modes of transport and mobility will come together as a service ecosystem to support behaviour change.